Money management is not just about saving money—it’s about making your money work for you. Whether you are a homemaker, a working woman, or a single mother managing everything on your own, understanding financial literacy is your key to a secure future.

In this article, I will break down practical steps for money management that any woman can follow to build and grow wealth.

1. Start with a Simple Budget (Ghar Ka Hisab-Kitab)

The first step to managing money is knowing where your money is going.

Take a notebook or use a simple mobile app like Walnut, Money Manager, or Google Sheets and start tracking:

✔ Income (salary, side income, government benefits, etc.)

✔ Expenses (household, rent, kids’ education, groceries, shopping, etc.)

✔ Savings & Investments

How to Do It Practically?

• Every evening, spend 5 minutes writing what you spent money on, that day.

• At the end of the month, check where extra money is going (like unnecessary shopping or online subscriptions).

• Reduce unnecessary expenses and allocate that amount to savings or investments.

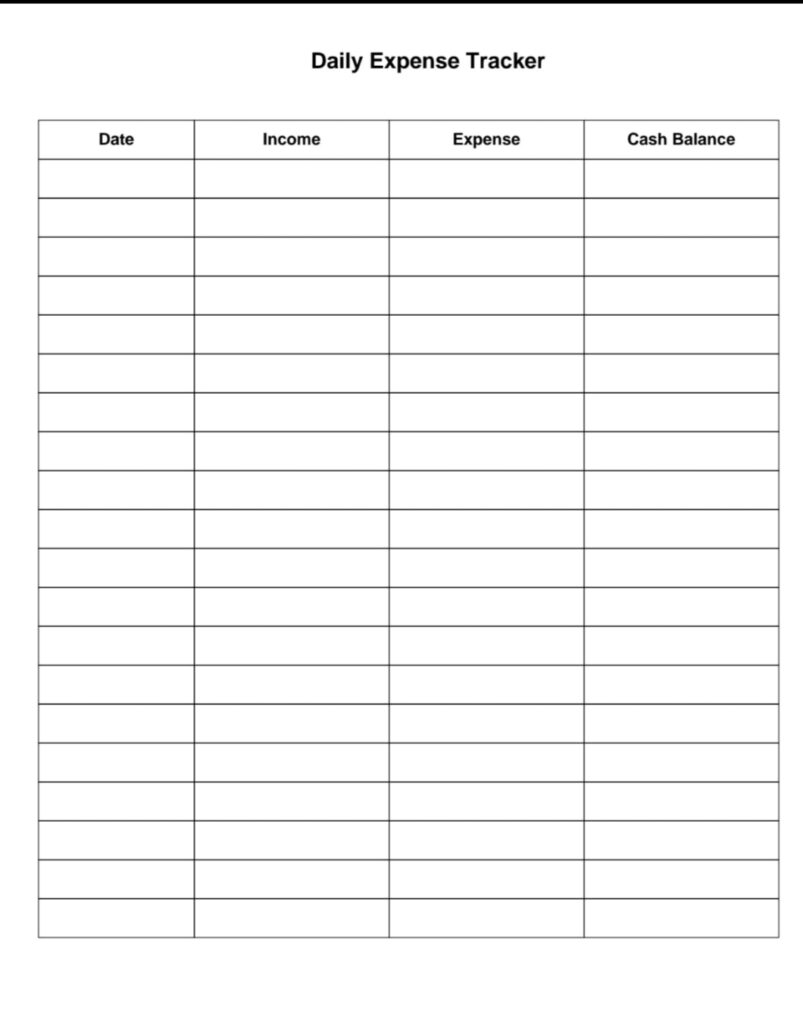

A simple budgeting template in for daily expenses

2. Emergency Fund – Your Financial Safety Net

Life is unpredictable—medical emergencies, job loss, or sudden expenses can happen anytime.

This is why every woman needs an emergency fund.

How Much to Save?

• Start with ₹5,000, then gradually increase it to cover at least 6 months of expenses.

Where to Keep It?

✔ Savings Account with High Interest – Kotak 811, IDFC First, SBI Flexi Deposit ( Check latest Interest updates )

✔ Liquid Mutual Funds – Better than FD, but easily withdrawable when needed ( Subject to market risk )

✔ Post Office RD (Recurring Deposit) – Good for safe savings

3. Smart Ways to Save Money Every Month

💰 “Jitni Bachat, Utni Kamai” – Saving money is like earning money!

Here are some practical saving hacks for Indian women:

✔ Monthly Grocery Budget – Buy in bulk, use cashback apps like CRED, Amazon Pantry.

✔ Cut Unnecessary Subscriptions – Check mobile recharge plans, WiFi plans, and streaming services.

✔ Use Cashback & Discount Apps – Paytm, Google Pay, and PhonePe offer cashback on bill payments.

✔ Buy Gold in Small Quantities – Digital Gold on Paytm, PhonePe, or Sovereign Gold Bonds (SGBs) are better than physical gold.

4. Grow Your Money – Best Investment Options for Women

Saving is not enough; you must invest to beat inflation!

Best Investment Options (for Beginners):

✔ SIP in Mutual Funds (Starting ₹500/month) – Grow your wealth long-term.

✔ PPF (Public Provident Fund) – Best for tax-free savings.

✔ Gold ETFs/SGBs – Better than buying physical gold.

✔ Fixed Deposits & RDs – Good for safe and stable returns.

How to Start Investing?

1️⃣ Open an account on Angelone , Zerodha, Groww, or Paytm Money.

2️⃣ Start a SIP in Index Funds (like Nifty 50) – safest for long-term wealth.

3️⃣ Invest in PPF & FDs for safe savings + tax benefits.

5. Earn More – Side Income Ideas for Women

Why depend on one income source when you can earn extra?

Best Side Hustles for Indian Women:

✔ Freelancing (Content Writing, Virtual Assistant, Data Entry, Teaching Online)

✔ Selling Handmade Products (Jewelry, Clothes, Home Decor) on Etsy/Amazon India/Instagram

✔ Starting a YouTube Channel or Blog (Cooking, Fashion, Financial Tips, etc.)

✔ Affiliate Marketing – Earn money by promoting products online.

How to Start?

1️⃣ Find your skill – What can you do well?

2️⃣ Join platforms like Upwork, Fiverr, LinkedIn, Instagram, Youtube or Facebook Groups.

3️⃣ Start small and grow your earnings!

6. Secure Your Family’s Future – Insurance & Will Planning

A single mother or any responsible woman should protect her family’s future.

✔ Health Insurance (At Least ₹5-10 Lakhs Cover) – Best plans: Star Health, Max Bupa, HDFC Ergo.

✔ Term Insurance (For Single Moms & Earning Women) – Cover should be 10x your annual income.

✔ Make a Simple Will – Protect your property, savings, and assets for your children.

Final Words: Take Charge of Your Money!

Managing money is not difficult, but it requires discipline and patience. If you start today, in 5 years, you will thank yourself for taking the right financial steps.

🔹 Start budgeting this month.

🔹 Build an emergency fund within 6 months.

🔹 Begin investing with just ₹500/month.

🔹 Explore a side hustle for extra income.

🔹 Secure your future with insurance & a simple will.

💬 Tell Me in Comments: Which step will you start first? Let’s build financial freedom together! 💰✨

jMatO EGOXXNro vlHlzlUI ujoJPNpQ yTfB Idd